iowa inheritance tax return schedules

When Iowa schedules are filed with the return only those schedules that apply to the particular assets and liabilities of the estate are required. Were going to be at 39 which of the states that have an income tax will be.

2021 Form Ia Dor 706 Fill Online Printable Fillable Blank Pdffiller

Stay informed subscribe to receive updates.

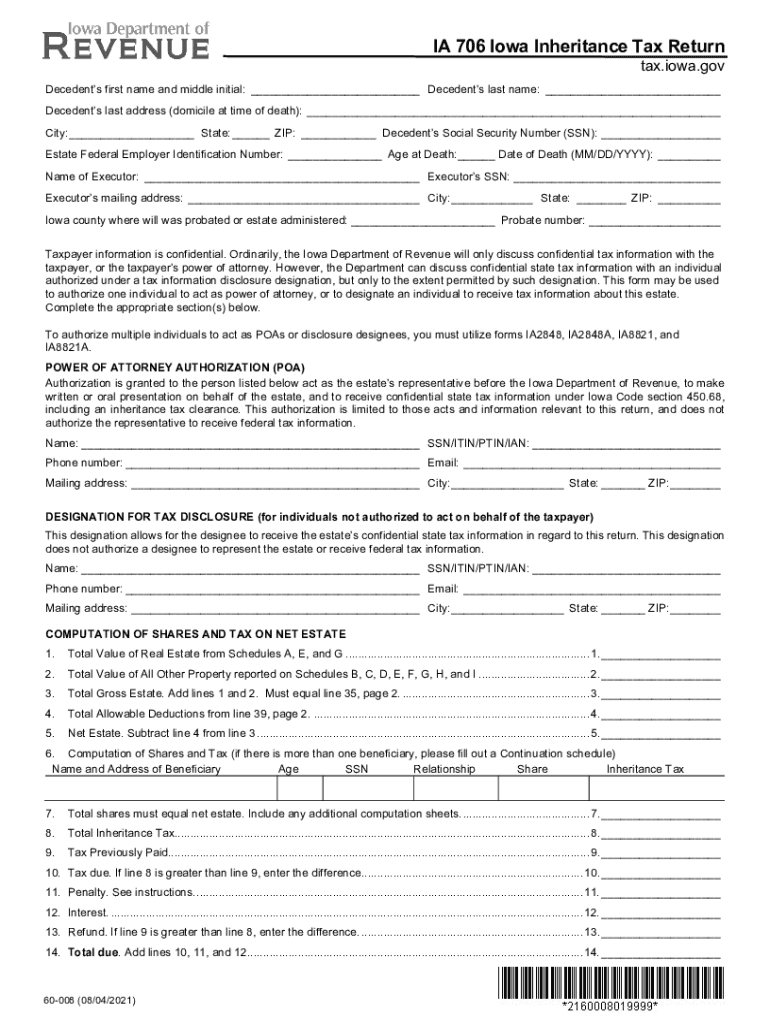

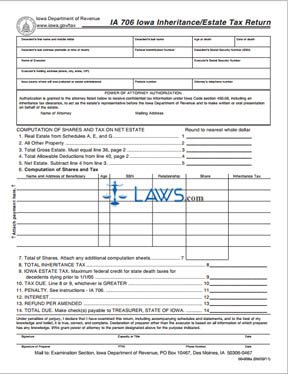

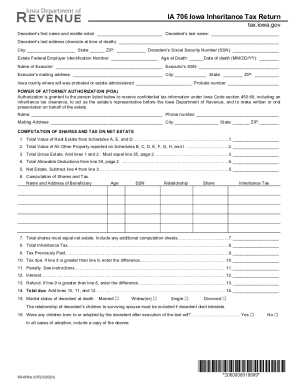

. INSTRUCTIONS FOR IOWA INHERITANCE TAX RETURN IA 706. Iowa InheritanceEstate Tax Return IA 706 Step 1. 29 representative to file an inheritance tax return.

Ad Download Or Email Form IT-R More Fillable Forms Register and Subscribe Now. Learn About Sales Use Tax. To pay inheritance and estate tax in the state of Iowa file a form IA 706.

Ad Download Or Email IA 706 More Fillable Forms Register and Subscribe Now. 2021 taxiowagov 60-062 01032022 Pursuant to Iowa Code chapter 450 the tax rates are as follows. The return is due 9 months from the death of the decedent.

Inheritance Tax Schedule K Other Forms Affidavit and Agreement for Issuance of Duplicate Warrant Other Forms. How much is the inheritance tax in Iowa. Inheritance Tax Rates Schedule.

If the federal estate tax return includes the schedules of assets and liabilities the taxpayer may omit Iowa Schedules A through I from the return. Completing the authorization on page 2 will authorize the attorney to represent the estate and receive confidential information. SUMMARY OF REAL AND PERSONAL PROPERTY LOCATED OUTSIDE OF IOWA NOT INCLUDED IN LINES 27-35 Note.

IA 706 Inheritance Tax Return Inheritance Iowa Inheritance Tax Consent and Waiver of Lien Inheritance Inheritance Tax Application for Extension of Time to File Attachmnet 12 - Forms Inventory 2 of 4. Stay informed subscribe to receive updates. An Iowa inheritance tax return must be filed and any tax due paid on or before the last day of the ninth month after the death of the decedent.

Track or File Rent Reimbursement. Register for a. This document is found on the website of the government of Iowa.

An extension of time to file the return and make payment may be requested from the Iowa Department of Revenue but interest is charged on unpaid taxes which remain due accruing on a monthly basis. It has an inheritance tax with a top tax rate of 18. Change or Cancel a Permit.

If youre an executor faced with preparing an inheritance tax return you can get. Iowa County Names and Numbers 76-002 Read more about Iowa County Names and Numbers 76-002 Print. The penalty 30 shall be waived if such return is filed and any tax due is paid 31 within the later of nine months from the date of death or sixty 32 days from the delivery or filing of the disclaimer pursuant to 33 section 633E12.

See IA 706 instructions. Inheritance Release of Tax Liens 60-047. TOTAL 60-008b 090111 IA 706 Iowa InheritanceEstate Tax Return page 2.

Read more about Inheritance Tax Rates Schedule. Track or File Rent Reimbursement. An extension of time to file the return and make payment may be requested by contacting the Department.

Even if an extension is granted on the return the tax payment is still due nine months after death. Iowa Inheritance Tax Schedule J 60-084. Register for a Permit.

It shrinks Iowas personal income tax rate to a single rate within four years. Department forms must be used for the Iowa inheritance tax return and Schedules J and K. This information is required.

Iowa Schedules A through I may be replaced with the IowaState Bar Association probate schedules. Learn About Property Tax. ITEMDescription REAL PERSONAL Include taxable intangible property in Schedules B through I.

Track or File Rent Reimbursement. Effective for estates of decedents dying on or after January 1 1988 the following rules apply when the surviving spouse succeeds to property in the estate. 14 That an Iowa inheritance tax return is filed for.

Even if no tax is due a return may still be required to be filed. The inheritance tax return must be filed and any tax due paid on or before the last day of the ninth month after the death of the decedent. Iowa InheritanceEstate Tax Return IA 706.

Learn more at the Iowa Department of Revenue. Inheritance tax can be complicated. Once the return is received the Iowa Department of Revenue will issue an inheritance tax clearance which terminates the automatic inheritance tax lien on the property in the estate.

File a W-2 or 1099. If the estate has filed a federal estate tax return a copy must be submitted with the Iowa return. Read more about Inheritance Release of Tax Liens 60-047.

The tax return is due nine months from the date of death unless the state Department of Revenue grants an extension. Iowa Inheritance Tax Rates. If the net estate of the decedent found on line 5 of IA 706 is less than 25000 the tax is zero.

Enter the decedents name date of death age at the time their address at the time of death and federal identification and Social Security numbers. Tax return must be filed and tax paid by the last day of the ninth month after the death of the life tenant. The Departments inheritance tax return and the liabilities Schedules J and K will be accepted.

These tax rates are based upon the relationship of the beneficiary to the deceased with no inheritance tax due from spouses and direct lineal descendants or ascendants ie. Iowa Inheritance Tax Schedule G and H 60-073. 1 If all of the property includable in the gross estate for inheritance tax purposes is held in joint tenancy with right of survivorship by husband and wife alone an inheritance tax return is not required to be filed and.

Should You Be Charging Sales Tax On Your Online Store Sales Tax Tax Filing Taxes

Iowa Estate Tax Everything You Need To Know Smartasset

Once Your Ehic Card Has Expired You Can Apply For A Ghic Card Uk Global Health Insurance Card Health Care Free Health Insurance Health Care Programs

Free Form Ia 706 Iowa Inheritance Estate Tax Return Free Legal Forms Laws Com

2021 Form Ia Dor 706 Fill Online Printable Fillable Blank Pdffiller

Iowa 706 Schedule J Fill Online Printable Fillable Blank Pdffiller